Cutting medication costs without cutting out prescribed medications is possible, you just have to do your homework.

Cutting medication costs without cutting out prescribed medications is possible, you just have to do your homework.

When I was working, I took a limited number of prescribed medications, but was frustrated by the high costs I paid in the form of co-pays. Over the years, my employer changed insurance companies and the co-pays increased and then came the tiers (or levels) of different co-pays. Once I was diagnosed with MS, I found a new level of co-pay hell with the worst of the insurance companies, yet. This particular insurance company had a great discount program for co-pays. Use the mail-order service, pay for two months and get one month of medication for free. I was ecstatic because the shots I was taking to try and stop the progression of the multiple sclerosis (MS) cost me $100 a month.

I ordered my first script from the required specialty pharmacy and I was informed that my insurance company would not allow me to order more than one month of medication at a time. I then called the insurance company and received the authorization to order the three month supply. Once again, I called the specialty pharmacy, expecting to be told that a $200 co-pay was required. My expectations were too high once again and so was my co-pay, I was asked to pay a $300 co-pay for the three month supply of my shots. Another call was made to the insurance company, where I questioned why I was being asked to pay the extra $100. These are the exact words I was told, “It’s an expensive medication.” Because I want to keep my blog classified as a family site, I won’t write what my exact response was.

Loopholes! Insurance companies, as well as many, many other businesses that you must deal with on a regular basis have loopholes to protect themselves. To make it more clear, they have ways called policies and procedures that are used to keep profit on their sides. In this case, their policies were referred to as “tiers.” My goal became finding my way through their teeny, tiny loopholes.

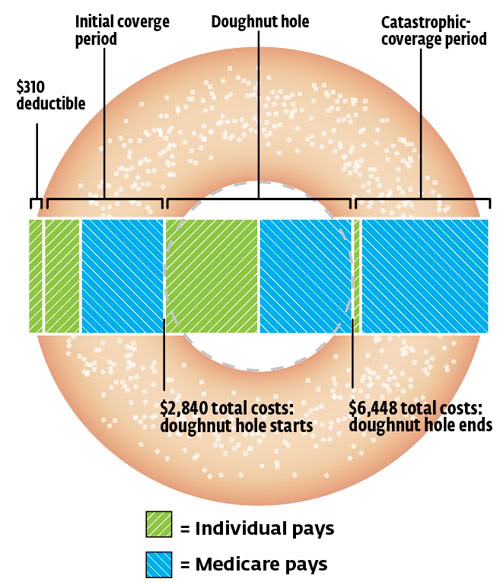

Find that way I did, eventually, and it’s a never ending maze to track through. However, these days the loopholes I battle are created by this great insurance company called Medicare. Medicare doesn’t actually provide you with medication coverage. Instead, it limits how much will be paid toward your prescribed meds for the year. This is what you often hear referred to as the Medicare Doughnut Hole. Once your Part D plan has paid their loopholed amount, you are in the Hole until you pay 100% of roughly the next $4,000 in medication costs. Depending on the plan, you may or may not get discounts on these drugs until you reach the other side of the doughnut hole. Once on the other side, you receive medication at drastically reduced prices.

Cutting Prescribed Medication Costs

So, how did I learn to navigate these loopholes and doughnut holes?

- Do your homework. Look up all of the pharamacies in your area or those where you shop regularly, don’t forget about your small town pharmacies. Many of them have free or low cost medication lists.

- Brookshire’s

- CVS

- Kmart (requires a $10 enrollment fee, but offers medications I can’t find elsewhere at these prices)

- Kroger (Dillon’s, Fred Myers, Fry’s, City Market, King Sooper, QFC, Ralph’s, Smith’s, Baker’s, Gerbes)

- Meijer

- Price Cutter

- Publix

- Rite aid (others seem cheaper)

- Sam’s Club

- Target

- Walgreens (requires a membership fee and NOT the best prices for my meds) Walmart

- Compare prices.

- Use online tools to look up prices (Missouri)

- Many pharmacies will match the price of a competitor of prescribed and over the counter drugs.

- Call local pharmacies and ask about their CASH price for your prescription. I ask my pharmacy NOT to run my low price scripts through my Part D coverage. This keeps more money available to pay for my high price medications.

- Switch to generic medications.

- Ask your doctor’s permission, sometimes they do NOT advise a generic.

- Switch if they are REALLY cheaper. With my Part D Plan, generics are 80% of cost while in the Doughnut Hole, but name brands are 50% of the cost. The name brand medications may end up being cheaper.

- Warning – some generic medications have really strange side effects, especially if they end with -pril. I had a horrible ticklish cough for nearly a year. After changing to a similar medication, the cough was gone within a couple of weeks. Report sudden and long lasting new problems to your doctor.

- Transfer your script to another pharmacy, if the other pharmacy offers free gift cards for a new or transferred prescription.

- Kmart currently offers a $25 gift card with a transfer

- Kroger frequently offer a $25 gift card with a transfer

- Price Cutter currently offers a $20 gift card with a transfer

- Publix frequently offer a $25 gift card with a transfer

- Walgreens currently offers a $25 gift card with a transfer

- Take advantage of loyalty or shopper reward programs.

- CVS get your Extra Bucks for filling scripts.

- Kroger offers 50 points per script

- Price Cutter has a punch card. Buy 12, receive a $20 gift card.

- Target will reward you with 5% off, all day, when you fill 5 scripts.

- Walgreens rewards you with 500 points for every scripts

- Seek out medications with positive side-effects. Ask your doctor if any of your medications have side effects that could possibly eliminate the need for other medications. Yes, this sounds crazy, but it saved me a LOT of money! I used to take one medication that was quite expensive, but I HAD to take it or risk dying. When my doc took me off the med that caused me to cough, he replaced it with a different one that was known to cause body to produce higher levels of the expensive drug. Viola! No more cough and I’m saving $150 a year!

- Ask your doctor for samples of high price medications that he may have available. My primary doctor is wonderful about giving me samples. He typically gives me a six to twelve month supply of my most expensive medications, when he has them available. Explain your finances to your doctor and that you can’t afford the medication, but be honest!

- Investigate your plan coverage.

- Call your insurance company and find out what quantity is covered by a co-pay. If your doctor only wants you to take one pill a day, but your plan will pay for you to take three pills a day, ask your doctor to write your script for 90 pills instead of 30 and use language such as “Take as directed.” This means you could get a three month supply for the price of one.

- If you need a 20 mg tablet, find out if the 40 mg tablet is the same price. If they are, ask your doctor to prescribe the 40mg tablet and “take as directed.”

- Apply for Medicaid, even if you don’t think you will qualify. You might be pleasantly surprised!

- Seek out other drug assistance programs. Go to the websites for your expensive medications. Many of them now have programs on their websites with the detailed information about what you need to do to qualify.

- Use discount cards. These may or may not help you. If you have insurance, these will probably NOT help you get a better price. They will likely save you on medications not covered by insurance though. I signed up for all of these to see if I could get a better discount from any one versus the other. Yes, some do offer different discounts.

Speak Your Mind